Rumored Buzz on Eb5 Investment Immigration

Table of ContentsThe 9-Second Trick For Eb5 Investment ImmigrationThe Best Strategy To Use For Eb5 Investment ImmigrationThe Only Guide to Eb5 Investment ImmigrationThe Definitive Guide to Eb5 Investment ImmigrationThe Main Principles Of Eb5 Investment Immigration

Contiguity is established if census systems share borders. To the level possible, the combined demographics tracts for TEAs need to be within one city location without any greater than 20 census systems in a TEA. The consolidated demographics systems should be an uniform form and the address should be centrally located.For more information concerning the program check out the U.S. Citizenship and Migration Providers web site. Please allow 1 month to process your request. We typically react within 5-10 service days of receiving qualification requests.

The U.S. federal government has actually taken actions aimed at increasing the degree of foreign financial investment for nearly a century. In the Migration Act of 1924, Congress introduced the E-1 treaty investor class to assist assist in trade by international sellers in the United States on a momentary basis. This program was expanded via the Immigration and Citizenship Act (INA) of 1952, which produced the E-2 treaty investor course to further draw in international financial investment.

employees within two years of the immigrant financier's admission to the United States (or in specific circumstances, within a reasonable time after the two-year period). Furthermore, USCIS may attribute investors with protecting tasks in a struggling service, which is specified as an enterprise that has been in existence for at the very least 2 years and has suffered a web loss throughout either the previous twelve month or 24 months before the priority date on the immigrant investor's first petition.

Eb5 Investment Immigration - The Facts

The program preserves stringent funding needs, requiring applicants to show a minimal qualifying financial investment of $1 million, or $500,000 if invested in "Targeted Work Locations" (TEA), that include certain designated high-unemployment or backwoods. Most of the accepted regional facilities establish investment chances that are located in TEAs, which qualifies their foreign capitalists for the reduced investment limit.

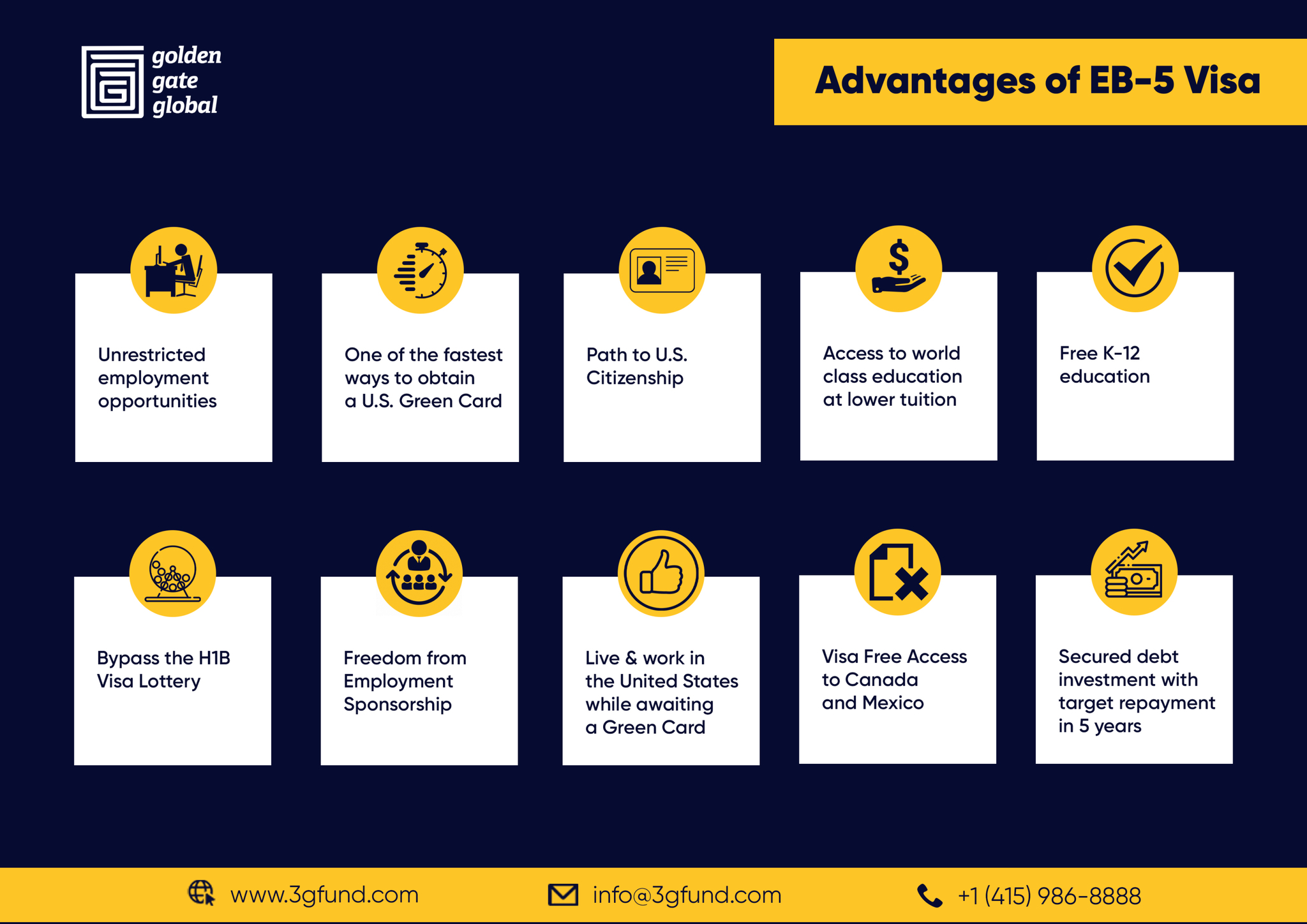

To certify for an EB-5 visa, a capitalist has to: Invest or remain in the process of investing at the very least $1.05 million in a new business venture in the United States or Spend or be in the procedure of investing at the very least $800,000 in a Targeted Employment Location. EB5 Investment Immigration. (On March 15, 2022, these amounts enhanced; prior to that date, the U.S

Extra especially, it's an area that's experiencing at the very least 150 percent of the national typical rate of joblessness. There are some exceptions to the $1.05 million company financial investment. One method is by setting up the financial investment service in an economically tested area. As an example, you might add a lower business investment of $800,000 in a backwoods with less than 20,000 in populace.

The Eb5 Investment Immigration Ideas

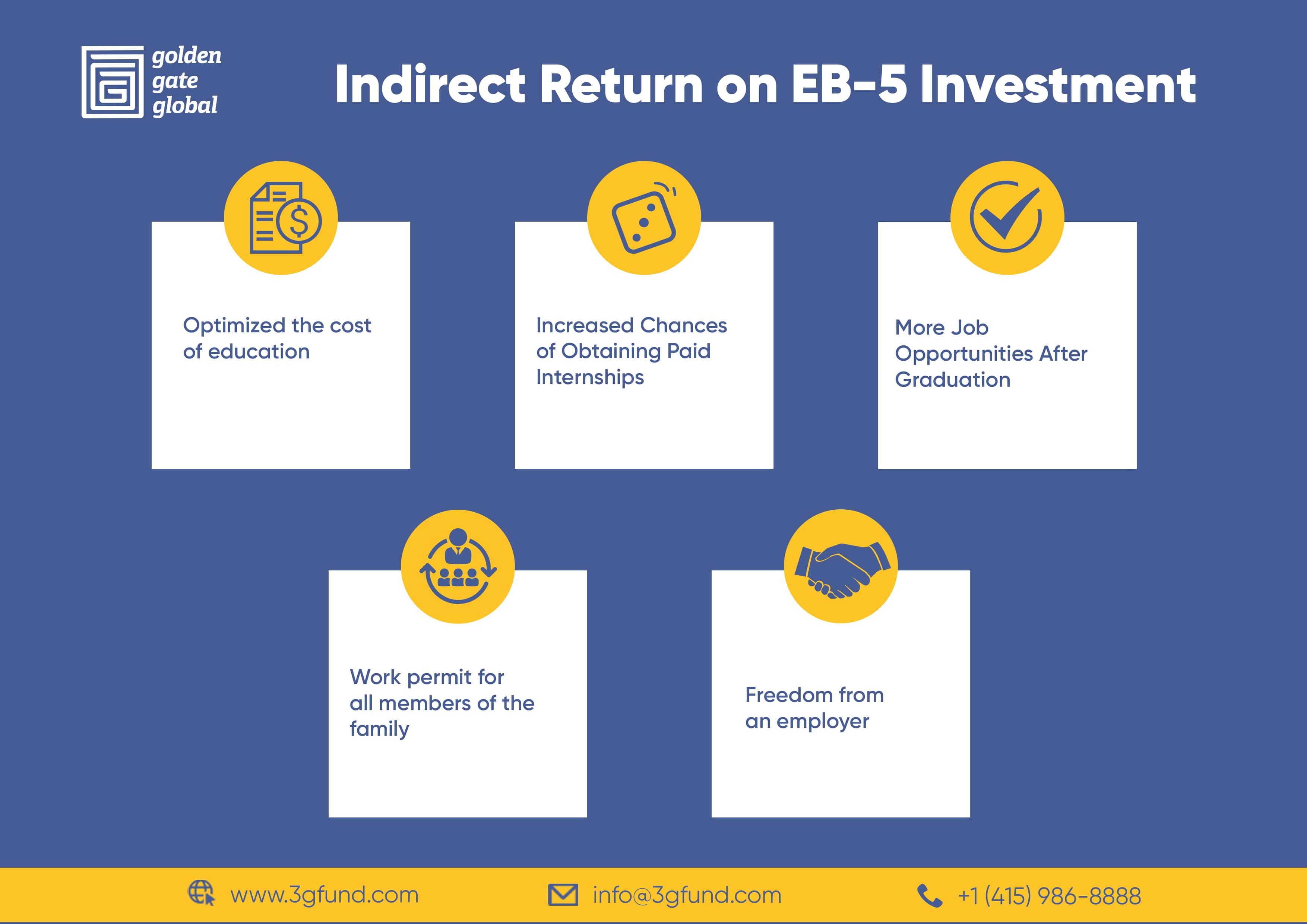

Regional Center investments permit for the factor to consider of economic impact on the neighborhood economic climate in the type of indirect employment. Any kind of financier thinking about spending with a Regional Facility must be really careful to take into consideration the experience and success price of the business prior to investing.

The investor first requires to submit an I-526 application with united state Citizenship and Immigration Provider (USCIS). This application has to consist of proof that the financial investment will certainly produce full time employment for at the very least 10 U.S. citizens, permanent residents, or various other immigrants that are licensed to operate in the United States. After USCIS approves the I-526 application, the financier might make an application for an environment-friendly card.

See This Report about Eb5 Investment Immigration

If the financier is outside the United States, they will certainly need to go with consular handling. Investor eco-friendly cards come with conditions affixed.

Yes, in particular circumstances. The EB-5 Reform and Honesty Act of 2022 (RIA) included section 203(b)( 5 )(M) to the INA. The brand-new area usually allows good-faith financiers top article to keep their eligibility after discontinuation of their local facility or debarment he said of their NCE or JCE. After we inform investors of the discontinuation or debarment, they may retain eligibility either by notifying us that they remain to satisfy eligibility demands regardless of the discontinuation or debarment, or by changing their petition to reveal that they satisfy the demands under area 203(b)( 5 )(M)(ii) of the INA (which has various demands depending on whether the capitalist is seeking to keep eligibility due to the fact that their regional center was terminated or since their NCE or JCE was debarred).

In all cases, we will make such resolutions consistent with USCIS policy regarding deference to prior decisions to ensure consistent adjudication. After we terminate a regional center's designation, we will certainly withdraw any kind of Form I-956F, Application for Authorization of a Financial Investment in a Company, related to the terminated regional center if the Form I-956F was approved as of the date on the regional center's discontinuation notification.

10 Easy Facts About Eb5 Investment Immigration Explained